Arizona budget faces GOP opposition as debate delayed

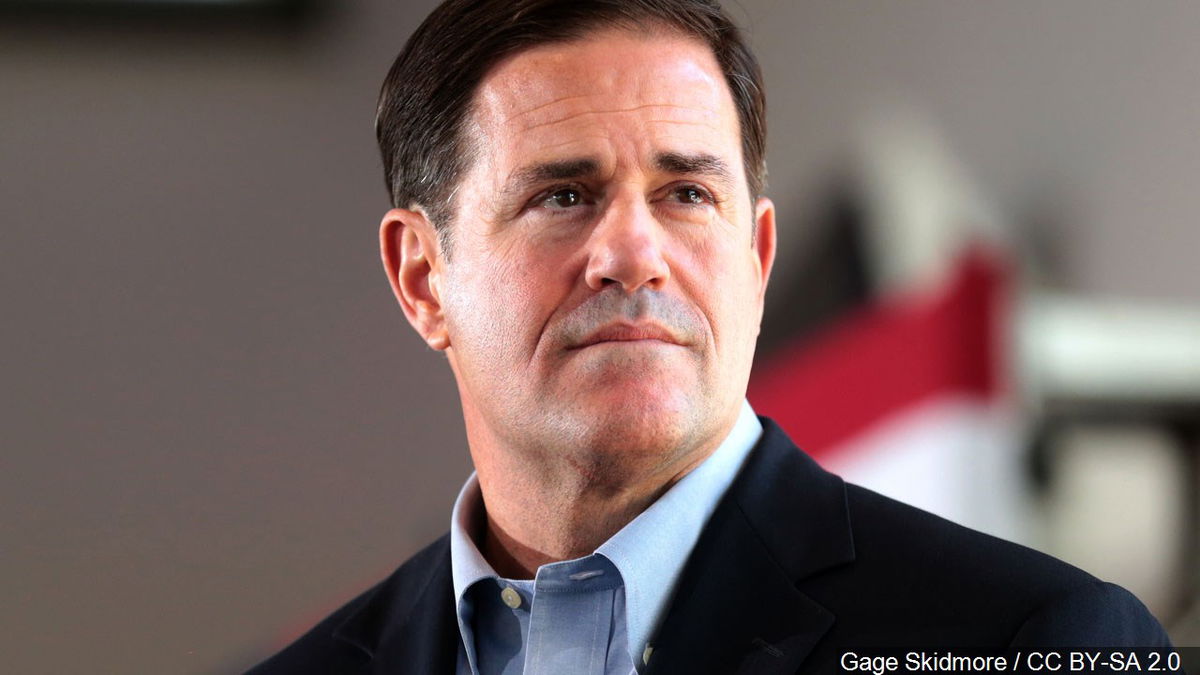

PHOENIX (AP) — Contentious division among Republican lawmakers about a state budget deal negotiated between GOP Gov. Doug Ducey and majority Republican legislative leaders is in the forefront as the Arizona House delayed a scheduled Wednesday debate.

Numerous Republican members of the House and Senate have expressed disdain for the deal. Some are opposed because of spending they say goes against their conservative fiscal beliefs, while others are concerned that a massive tax cut could hurt cities or undermine the state’s finances.

The added spending, which includes nearly $160 million for roads alone and pay raises for many state workers, brought some GOP members on board. But it was clear Wednesday that Republicans, who hold just one-vote majorities in both chambers and lack any Democratic support for the $12.8 billion spending plan, did not have enough support.

Early Wednesday evening, the spokesman for Arizona House Republicans, Andrew Wilder, confirmed debate on the budget would not happen until at least Thursday, after hours of delays. Two hours later, Senate President Karen Fann announced that the House planned to adjourn until sometime after the Memorial Day weekend, possibly as late as June 10.

Fann, however, told members she plans to debate and hopefully pass the budget out of the Senate on Thursday.

That may be ambitious, since at least two Senate Republicans have concerns with the deal Fann, House Speaker Rusty Bowers and GOP Gov. Doug Ducey have agreed upon.

“It’s pretty dang clear we don’t have the votes,” Sen. T.J. Shope of Coolidge, a Republican who backs the plan, said Wednesday morning. “I don’t know at what point we pull the plug.”

Another Republican, Sen. Paul Boyer of Glendale, said he was concerned about the huge tax cut and several other provisions in the plan.

“It’s really a long-term concern for the state of Arizona,” Boyer said on KJZZ radio Wednesday morning. “What does that do if and when we have an economic crisis? Are we prepared for it, especially if we’re cutting a third of our income to our state.”

Boyer told The Associated Press in a text message early Wednesday afternoon that he had just left negotiations with the governor’s office on city funding, a main point of contention for some lawmakers. He said no deal was in place. Separately, GOP Sen. Michelle Ugenti-Rita has said she thinks the budget spends too much money.

A group that represents cities and towns is pushing for changes to address what it says will be a $280 million-a-year hit to tax revenue its members get as a share of the state income tax. Several Republicans say they can’t back the plan unless those concerns are addressed. The League of Arizona Cities and Towns is requesting an increase in the 15% share of income tax cities now receive.

Republican Rep. Jake Hoffman, a freshman from Queen Creek, is opposed to some of the spending in the plan. He voted against all 11 budget bills in the House Appropriations Committee on Tuesday. He said he’s looking forward to changes that will secure his and other like-minded GOP members’ votes. And GOP Rep. David Cook of Globe has numerous concerns he said Tuesday that leadership and Ducey have not addressed.

The opposition from Republicans puts Fann and Bowers in difficult positions, because trying to woo one side could easily lose votes on the other. And some of those members who agreed to the massive tax cut, which works out to $1.9 billion once it is fully in place in three years, could fall off the plan if spending on projects like roads, universities and other priorities is cut to appease the fiscal hawks.

Democrats are solidly opposed to the tax cuts, saying the state still has too many needs to slash revenue.

The proposed cuts include $1.5 billion to eliminate the state’s graduated income tax rate and replace it with a flat 2.5% rate for all income levels — a cut of more than 25% of all income tax revenue. Also included is a provision that uses general fund revenue to shield the wealthy from a new 3.5% tax surcharge voters approved in November to fund education. That will cost about $400 million a year and leave high earners paying just 4.5% total tax instead of 8%.. Other tax provisions include a small increase in a child tax credit and a cut in business property tax rates.

“There are certain things that brought people on to that budget — that made them OK with voting for the flat tax — that are the very things that other people are opposed to in the spending part,” Shope said.