Nearly 60% of parents with young children in debt due to the coronavirus

(KYMA, KECY)-A Lending Tree survey shows the financial fallout from the coronavirus pandemic is difficult for parents with younger children.

Fifty-six percent of parents have gone into debt due to the coronavirus pandemic, according to a LendingTree survey of more than 1,000 parents with children under 18.

Key Findings

- 56% of parents have gone into debt due to coronavirus-related circumstances. Four in 10 added credit card debt, and 15% had to turn to a personal loan.

- Single parents are struggling more to pay bills amidst the coronavirus pandemic. Nearly 1 in 5 parents who are single, divorced or separated couldn’t pay their credit card bill last month, versus 9% of married parents. Fifteen percent couldn’t pay their rent or mortgage in full.

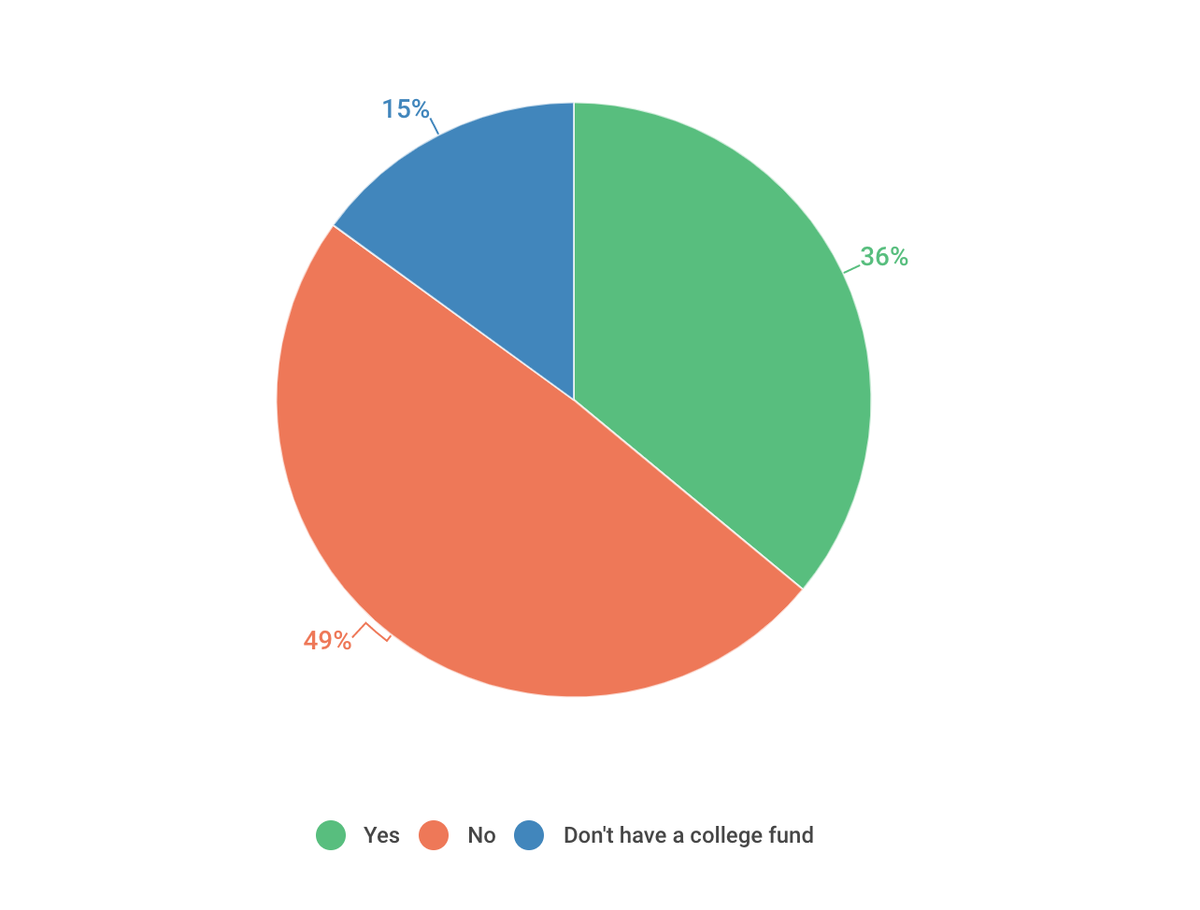

- 36% of parents tapped their child’s college fund to help cover expenses due to the financial strain caused by the COVID-19 outbreak.

- 6 in 10 parents had to spend money for their child’s distance learning. On average, they spent a little over $1,000 on supplies ranging from iPads and laptops (48%) to office furniture (15%).

- Parents said the hardest part of the coronavirus pandemic has been trying to work from home while taking care of kids (31%). They’re also struggling to manage their child’s distance learning (19%) while dealing with financial strain caused by income loss (18%).

According to the survey, parents spent over $1,000 on distance learning supplies on average.

More than a third of parents tapped into college funds to cover expenses.

But what are the parent's biggest challenge during this quarantine?