Tax Tip Tuesday: U.S. Treasury defers tax payments 90-days past April 15th deadline

Coronavirus outbreak causing U.S. Treasury to temporarily waive penalties and interest on tax payments

YUMA, Ariz. (KYMA, KECY) - As the country tries to grapple the spread of the coronavirus, many Americans have been mandated to work from home.

But there are tons of industries that simply don’t fit into that category, leaving thousands of Americans without a paycheck.

As a result, their tax refund may be their only saving grace.

The sudden coronavirus outbreak has changed the day to day life for Americans.

It's all happening right in the midst of tax season.

According to the IRS, so far this tax season, the average tax payer’s refund has been about $3,000.

Now, with the coronavirus invading not only immune systems but workplaces, thousands of Americans are out of work and will probably need some extra cash.

That’s why the IRS is urging Americans to continue to file their taxes electronically by April 15th and opt for direct deposit to get your refund as soon as possible.

IRS special agent, Brian Watson suggests using software programs on your home computer or even on your phone.

"It’ll walk you through the questions and get you the biggest refund possible. You’ll pay the least amount of taxes legally possible," Watson said.

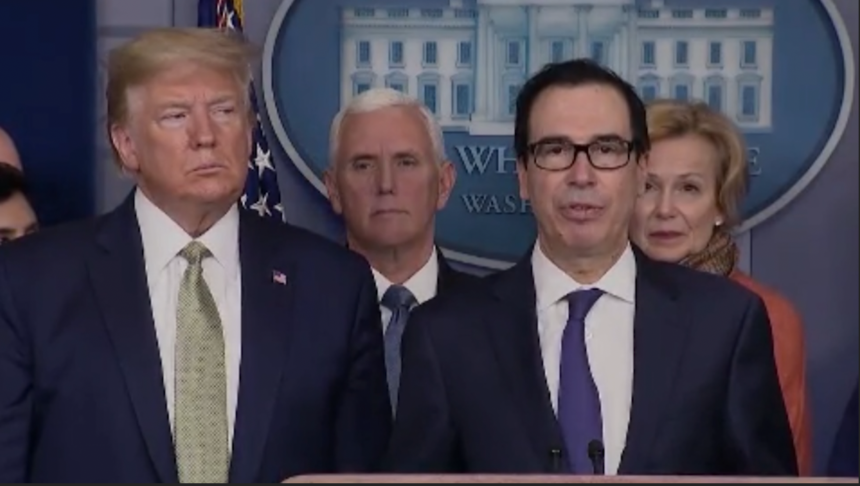

Tuesday during a White House briefing on the coronavirus, U.S. Treasury Secretary, Steve Mnuchin announced the IRS will waive penalties and interests on tax payments 90-days beyond the April 15th deadline.

Mnuchin said, “if you owe a payment to the IRS, you can defer up to $1 million as an individual.”

For now, that's one less burden for Americans to bear.

If you make less than $69,000 a year, you can e-file your taxes for free on IRS.gov.

Of course, there are several safe and affordable tax filing software also available online.