Free tax filing program available in San Luis

City of San Luis and the Catholic Community Services of Southern Arizona partnered together for the program

SAN LUIS, Ariz. (KYMA, KECY) - The City of San Luis said it has partnered with a local organization to offer free tax preparation services to San Luis residents through the Volunteer Income Tax Assistance (VITA) Program.

This program is for underserved communities and to help low-to-moderate income individuals, people with disabilities, the elderly, and those with limited English with their tax preparation, said the city.

The VITA program wants to ensure that families and individuals can receive the tax credits they're eligible for.

Individuals will be asked to provide:

- Driver's License or Picture Identification for the taxpayer (and spouse, if applicable),

- Social Security Card or Individual Taxpayer Identification Number for each member of the household,

- A copy of last year's filed tax return,

- Any letters the Internal Revenue Service issued for each person listed on the refund,

- Documentation regarding other types of income (W-2 or 1099), documents showing tax withheld, deductions, and credits, such as health insurance, must be provided.

The program is open and will run through April 13.

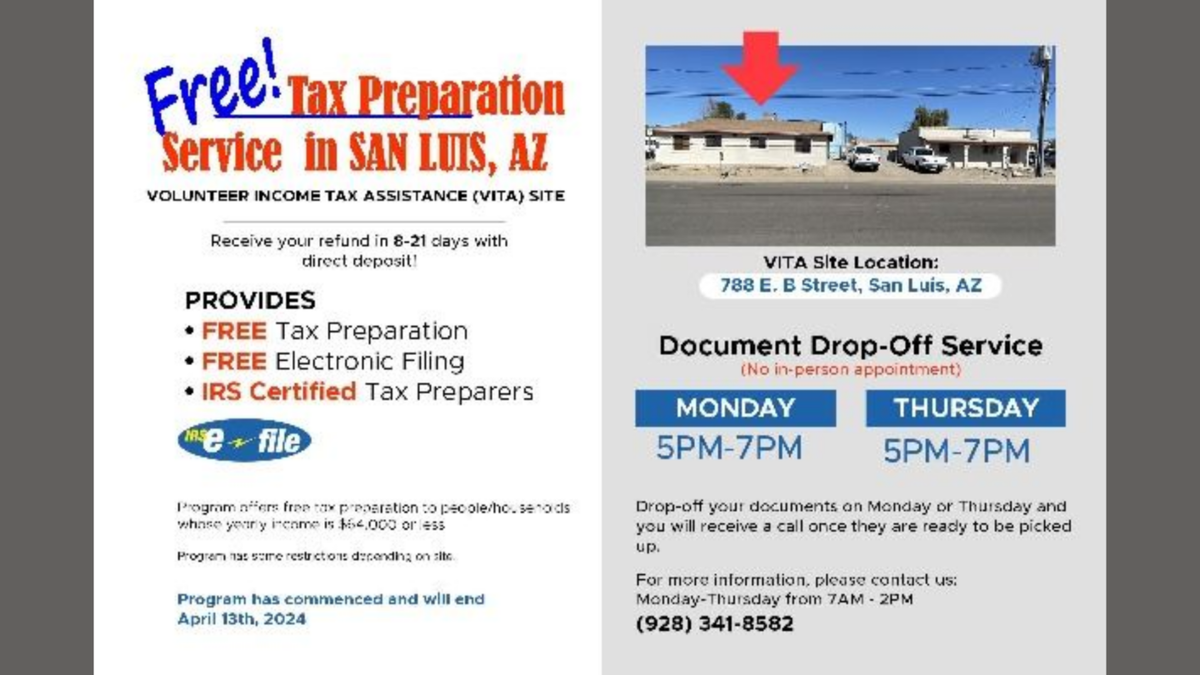

There are no in-person appointments, but will be accepting documents at 788 E. B Street, San Luis, Arizona, on the following days:

- Mondays, from 5:00 p.m. to 7:00 p.m.

- Thursdays, from 5:00 p.m. to 7:00 p.m.

If you have any more questions, call (928) 341-8582, Monday through Friday, from 7:00 a.m. to 2:00 p.m.